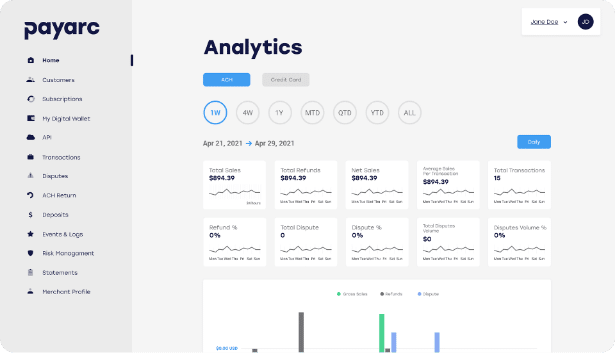

Expand your reach with omnichannel payments

In Person

Never miss a sale

again with the ability

to accept payments wherever you are.

E-commerce

Take full advantage of

our robust payment platform and streamline your online payment systems.

API Integration

Fully customizable payment experiences.

Point of Sale

Increase efficiency,

control inventory, and manage employees for retail and restaurants.

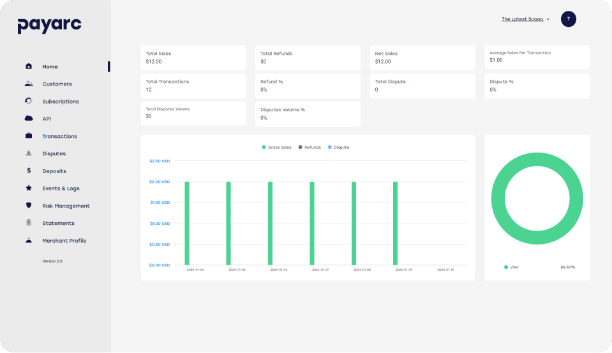

Your new

business HQ

PAYARC’s seamless experience eliminates the need to work with multiple third-party providers, empowering businesses to perform better, think smarter, and increase profit.

Businesses of any size can also beat fraud, send invoices, reduce friction at checkout, manage transactions, offer subscription services, and so much more.

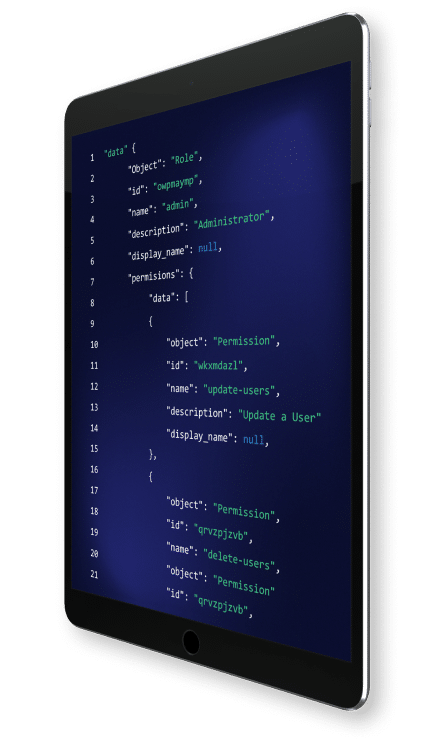

Secure, powerful, & easy-to-use API

PAYARC’s seamless experience eliminates the need to work with multiple third-party providers, empowering businesses to perform better, think smarter, and increase profit.

Businesses of any size can also beat fraud, send invoices, reduce friction at checkout, manage transactions, offer subscription services, and so much more.

Security & Compliance

Our payment APIs include end-to-end encryption and sophisticated security features that protect you against cyber criminals and fraud.

Our platform. Your terms.

Whether you’re selling in person or online, we can help you accept all kinds of payments quickly, securely, and with no monthly fees.

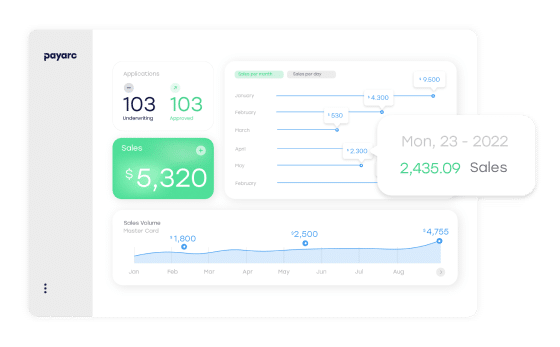

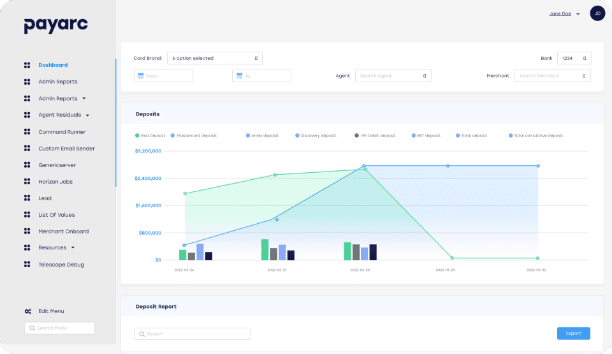

Your business at your fingertips

Generate customizable invoices from your dashboard and collect one-time or recurring payments with just one click. Stay on track with our reporting and cash flow management tools and automate your invoicing workflows and accounts receivable process.

Get paid faster

Generate customizable invoices from your dashboard and collect one-time or recurring payments with just one click. Stay on track with our reporting and cash flow management tools and automate your invoicing workflows and accounts receivable process.

Your business at your fingertips

Generate customizable invoices from your dashboard and collect one-time or recurring payments with just one click. Stay on track with our reporting and cash flow management tools and automate your invoicing workflows and accounts receivable process.

Virtual Terminal

Make payments simple to process and track by turning your computer into a payment terminal that accepts credit and debit cards.

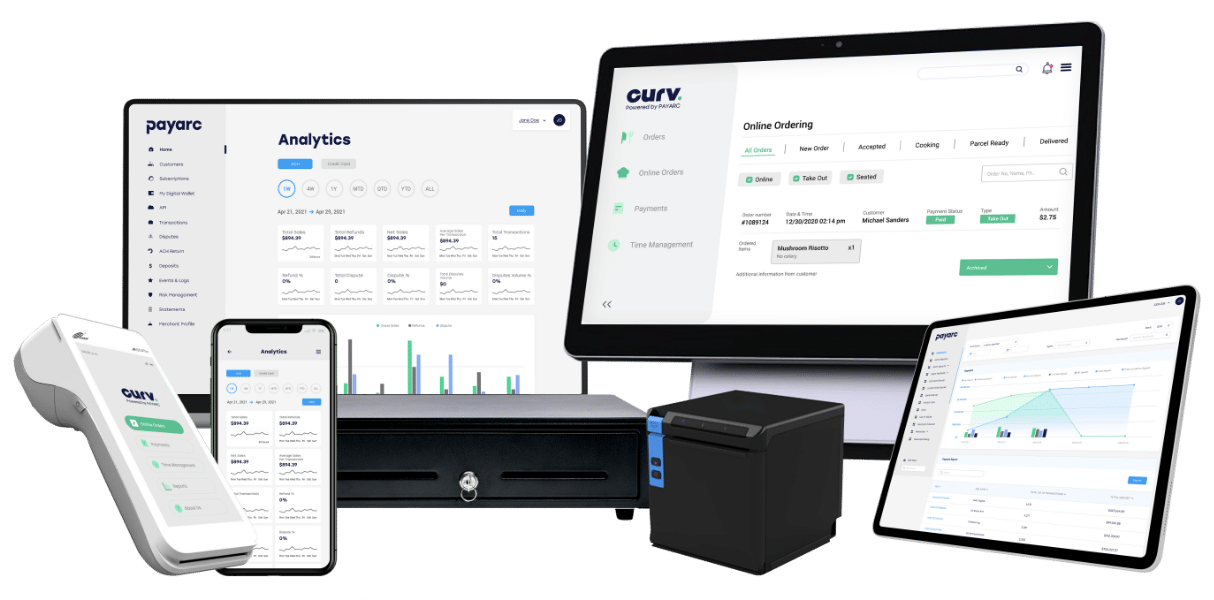

Powerful POS platform with Omnichannel Solutions

Point of Sale options that drive sales and increase profit, specifically designed for restaurants and bars

Flexible

Pricing

Eliminate processing fees with dual pricing

Delivery Integrations

Save 30% on commission fees with 3rd party plugins

Complete Customization

Set up order numbers, names, assign servers, add customers, etc.

Real-Time Reporting

Manage customers, employees, tables, menus, and more

Latest trends,

insights, and news